The Award-Winning App That Turns Teens Into Money Masters

Deliver A-level financial education without writing a single lesson plan.

Teach Students to Budget, Invest, and Evaluate Real-World Money Decisions—All Through Play!

CLICK BELOW TO WATCH FIRST!

4.9/5 star reviews

Thousands of happy customers worldwide

AS SEEN ON

Today's Students Face Adult Financial Decisions Earlier Than Ever—Are They Ready?

Does this sound like you?

Students zone out during traditional money lessons.

Hard to show real consequences of bad financial choices safely.

Lack of ready-made materials aligned to standards.

Limited class time to cover every concept.

Difficulty tracking individual student mastery in large classes.

Plug-and-play missions that meet state & national standards.

Live dashboards that visualize each student's growth.

Engaged learners who can explain compound interest.

Flexible gameplay that fits any schedule—10 minutes or full blocks.

Proof of mastery data for reports, grants, and board meetings.

Inside Your Finance Quest Subscription

Getting Started & Dashboard Tour

Set up your teacher dashboard, assign missions, and track mastery in minutes.

Game Mechanics Deep Dive

Understand how the Monopoly-style board, dice rolls, and surprise cards teach core money concepts.

Budget & Cash-Flow Missions

Guide students through fixed vs. variable expenses, emergency funds, and pay-yourself-first strategies.

Saving vs. Investing

Students compare savings accounts, CDs, stocks, ETFs, and compound-interest effects.

Credit & Loans

Simulate borrowing, interest rates, credit scores, and debt management.

Crypto & Emerging Tech

Introduce blockchain terms, risk assessment, and safe wallets at an age-appropriate level.

TESTIMONIALS

What our students are saying...

" My 7th-graders beg to play Finance Quest every Friday. Their post-test scores jumped from 62% to 91%. "

- Mr. Andrew Lopez

" As a homeschooling parent, I finally found a program that teaches money without dry lectures. My son now tracks his own expenses! "

- John Doe

" Our district needed a standards-aligned financial-literacy tool. Finance Quest not only meets standards—it exceeds engagement expectations. "

- Roberta Johnson

MODULES

FOLLOW MY STEP BY STEP VIDEO TRAINING

Getting Started & Dashboard Tour

Set up your teacher dashboard, assign missions, and track mastery in minutes.

Game Mechanics Deep Dive

Understand how the Monopoly-style board, dice rolls, and surprise cards teach core money concepts.

Budget & Cash-Flow Missions

Guide students through fixed vs. variable expenses, emergency funds, and pay-yourself-first strategies.

Saving vs. Investing

Students compare savings accounts, CDs, stocks, ETFs, and compound-interest effects.

Credit & Loans

Simulate borrowing, interest rates, credit scores, and debt management.

Crypto & Emerging Tech

Introduce blockchain terms, risk assessment, and safe wallets at an age-appropriate level.

Real-Estate & ROI

Students model buying vs. renting, mortgages, and cash-on-cash return.

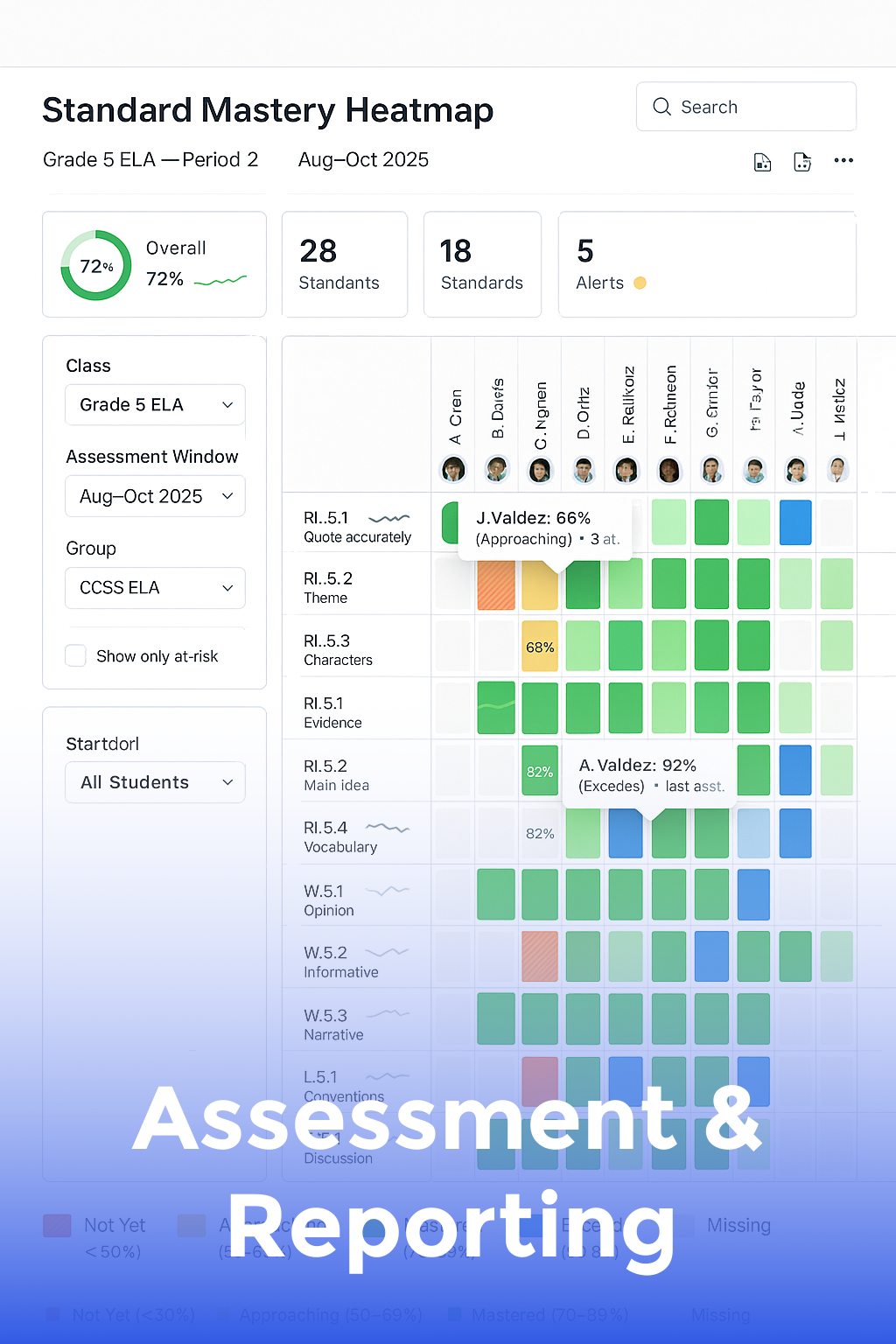

Assessment & Reporting

Export grades, align to state standards, and use data to drive instruction.

4.9/5 star reviews

Level Up Money Skills with Finance Quest

A gamified, standards-aligned curriculum that teaches grades 6–12 how to budget, invest, and make smart money moves—all inside an immersive strategy game.

Here's what you get:

Instant classroom access for up to 150 students.

Printable lesson plans & alignment charts for all 50 states.

24/7 educator community & live monthly PD webinars.

Automatic content updates as financial laws and markets evolve.

Today Just

$997 one time

"Best purchase ever!"

" As a homeschooling parent, I finally found a program that teaches money without dry lectures. My son now tracks his own expenses! "

ABOUT YOUR INSTRUCTOR

Meet Dotun

Finance Quest was created by Dr. Maya Patel, a former math teacher turned FinTech curriculum designer with more than 20 years of classroom and industry experience.

While teaching algebra, Dr. Patel noticed students glaze over during money lessons but light up during strategy games. She set out to merge game mechanics with real-world finance to keep kids engaged while learning life-changing skills.

Schools using Finance Quest report a 38% jump in financial-literacy scores and a 94% student engagement rate within one semester.

Named Top 50 Women in FinTech Education by EdTech Magazine

Curriculum adopted by 2,000+ schools across 42 states

Ph.D. in Financial Education & Behavioral Economics

Keynote speaker at the National Jump$tart Financial Literacy Conference

Winner of the 2023 Classroom Innovation Award

Co-author of the state-approved Financial Literacy standards for Grades 6-12

WHO IS THIS FOR...

Perfect for middle- and high-school teachers, parents, and districts seeking engaging, measurable financial-literacy instruction.

Middle School Teachers

High School Teachers

Homeschool Parents

Afterschool Program Leaders

Curriculum Directors

Youth Financial Literacy Non-Profits

School Counselors

EdTech Enthusiasts

STILL NOT SURE?

Satisfaction guaranteed

We want you to find value in our trainings! We offer full refunds within 30 days. With all of our valuable video training, we are confident you WILL love it!

STILL GOT QUESTIONS?

Frequently Asked Questions

Is Finance Quest aligned to my state's standards?

Yes. The curriculum maps to Jump$tart, CFLE, and individual state frameworks. Alignment charts are included.

Do I need gaming experience to facilitate?

Not at all. If you can click "Start Mission," Finance Quest guides the rest. We also provide tutorial videos and live support.

What devices are supported?

Finance Quest runs in any modern browser on Chromebooks, iPads, PCs, and Macs. No downloads required.

Enroll in the course now!

Copyrights 2024 | Finance Quest™ | Terms & Conditions